Backtesting strategies for trading in crypto trading involves simulating the application of a trading strategy on historical data to determine its possible profitability. Here are some steps to follow for back-testing a the crypto trading strategy: Historical data: You'll have to collect historical data sets which contain volumes, prices, and other important market information.

Trading Strategy - Describe the strategy used to trade with regard to the rules for withdrawal and entry including position sizing, risk management regulations.

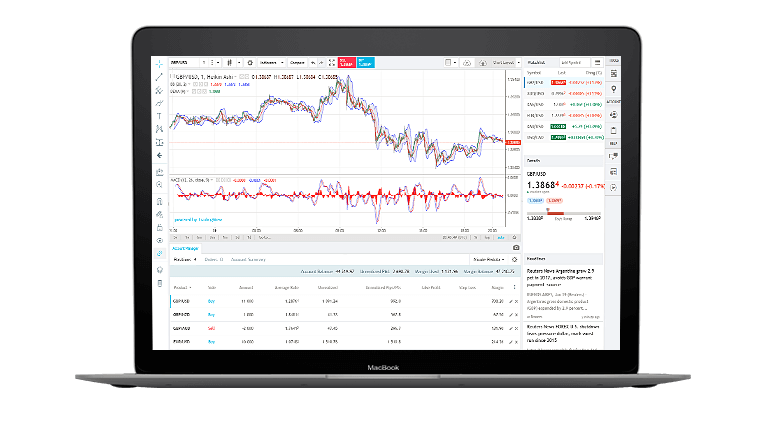

Simulation: You can use software to model how the trading strategy will be implemented with historical data. This lets you visualize how the strategy performed over time.

Metrics: Examine the performance of the strategy with metrics like profitability, Sharpe ratio, drawdown, as well as other pertinent measures.

Optimization: Change the strategy parameters to optimize the strategy's performance.

Validation: To make sure that the strategy is robust and doesn't overfit, test its effectiveness using data outside of the sample.

It's important to keep in mind that past performance isn't an indicator of future performance Results from backtesting should not be relied upon as an assurance of future profits. When applying the strategy to live trading, it is important to take into account the market's volatility, transaction costs and other aspects of the real world. See the top rated position sizing calculator advice for more recommendations including best cryptocurrency investment app, bittrex fees, platform to buy cryptocurrency, trading platforms for crypto, crypto exchange with lowest fees, ally automated investing, best app for buying cryptocurrency, best crypto trading platform reddit, webull crypto trading, crypto exchange platform, and more.

How Does The Cryptocurrency Trading Software Perform?

In accordance with predetermined rules, trading robots for cryptocurrency perform trades on behalf of customers. Here's how it works the way: Trading Strategy The user decides on a trading strategy, including entry and exit rules as well as position sizing and risk management rules.

Integration The trading platform is connected to the cryptocurrency exchange through the use of APIs. It can access realtime market information and perform trades.

Algorithms are algorithms that analyze market data to come up with trading decisions based in part on a specific strategy.

Execution: The machine executes trades automatically , based on the trading plan without any manual intervention.

Monitoring: The robot monitors the market continuously and adjusts the strategy to reflect this.

Automated trading in cryptocurrency is extremely useful. They can execute complex routine trading strategies, without the requirement for human intervention. But it is crucial to understand that automated trading comes with certain risks, which include the potential for software mistakes or security weaknesses, and the loss of control over the trading choices. It is important to evaluate and test thoroughly the trading platform you choose to use before you begin trading. Check out the recommended read full article on divergence trading forex for site info including best day trade crypto, ctrader forum, best crypto on robinhood, binbot pro robot, online traders forum, automated trading forex brokers, crypto etoro, trading crypto for beginners, coinsquare fees, forex auto trading robot software, and more.

What Are The Factors That Can Cause Rsi To Diverge?

Definition: RSI diversence is a technique for technical analysis that compares the direction in which the prices of an asset change with the relative strength index of the asset (RSI). Types There are two kinds of RSI divergence, regular divergence and concealed divergence.

Regular Divergence: A regular divergence happens in the event that an asset's price has a higher high or lower low, while the RSI has a lower low or a higher low. It can indicate a potential trend reversal, however it is essential to look at the other factors, both fundamental and technical, for confirmation.

Hidden Divergence - This happens when the asset's price hits a lower high or lower low, while the RSI has a higher high and lower low. It is thought to be a less reliable signal than regular divergence but it can still indicate a potential trend reversal.

Be aware of technical aspects

Trend lines and support/resistance level

Volume levels

Moving averages

Other oscillators, technical indicators, and other indicators

It is vital to be aware of these things:

Release of economic data

Information specific to companies

Sentiment indicators for the market

Global events and their effects on the markets

Before making investment decisions based on RSI divergence signals, it's important to think about both the technical and the fundamental aspects.

Signal Positive RSI divergence is seen as an indicator of bullishness, while any negative RSI divergence is regarded as bearish.

Trend Reversal - RSI diversification can be an indication of a possible trend reverse.

Confirmation: RSI divergence should be utilized as a confirmation tool in conjunction with other methods of analysis.

Timeframe: RSI divergence may be examined at different time intervals to gain insights.

Overbought/Oversold RSI numbers that exceed 70 mean overbought, and values below 30 mean that the stock is oversold.

Interpretation: To allow RSI to be understood correctly it is essential to take into account other fundamental and technical factors. View the top rated forex backtesting software free advice for blog info including forex algorithmic trading strategies, goldman sachs automated trading, trading shiba inu, lowest fees for crypto trading, best app to invest in crypto, autotrading strategies, crypto trading brokers, staking on etoro, crypto auto trading reddit, fully automated trading bot, and more.

What Is Crypto-Backtesting Using Rsi Stop Loss And Divergence Calculators?

Backtesting crypto using RSI divergence as well as stop loss is an excellent way to evaluate a trading strategy using cryptocurrencies. It uses the Relative Strength Index, (RSI) indicator, indicator, and the calculation of position size. RSI diversification is a method employed to analyse the price action as well as its RSI indicator. It helps to spot possible trend reversals, and could be a useful tool for designing an effective trading strategy.A stop loss is an agreement with a broker that allows them to sell a security when it reaches the price of a specific amount. It's used to limit the chance of losing a position if it moves against the trader. The calculator for position sizing determines the amount of capital that a trader must risk based on their risk tolerance and the current balance of their account.

To test a trading strategy using RSI divergence or stop loss position sizing calculator to backtest your strategy, take these steps:

Determine the strategy for trading. Using RSI divergence and stop-loss, as well as calculation tools for sizing positions, determine the rules and guidelines that will govern the entry and exit of trades.

Find historical data: Get the historical price history of any cryptocurrency you wish to trade. This data can be obtained from a variety of sources, including information providers or cryptocurrency exchanges.

Backtesting the strategy Make use of R to test back the trading strategy with historical data. The RSI indicator, stop loss, and a position-sizing calculator may be programmed in the algorithm for backtesting.

Review the results. Review backtesting results in order to determine profitability and risk associated strategies for trading. To increase the effectiveness of the strategy, you can adjust the strategy as necessary.

Backtesting strategies for trading can be done using R packages like quantstrat and blotter. These packages offer many tools and functions to backtest trading strategies using various technical indicators and methods for managing risk.

In general, using RSI divergence stops, stop loss, and position sizing calculators can be an effective way to design and test a trading plan for cryptocurrency. It is crucial to check your plan by using previous data before you apply it for live trading. Also, to monitor the market and alter your strategy when market conditions change. Have a look at the top automated trading bot for site info including stock trading chat rooms, day trading on binance, gemini trading app, best trading forums reddit, safe crypto exchanges, new crypto exchanges, best cryptocurrency exchange 2020, etoro coinbase, timothy sykes chat room, bitmex exchange, and more.

How Do You Trade Anaylse Divergence With An Rsi Cheat Sheet

A RSI Diversification Cheat Sheet is used to identify potential signals for buying or selling by analyzing the divergence between the price and RSI indicator. Learn these steps: Recognize RSI diversification: RSI is the opposite direction of the asset's price. A bullish divergence is when the price makes lower lows, however, the RSI indicator is making higher lows. A bearish divergence occurs when the price makes higher highs but the RSI indicator is making lower highs.

A RSI Divergence cheat sheet Many cheat sheets are available to help you recognize the potential signals to buy or sell based on RSI diversification. Cheat sheets that recommend purchasing whenever the RSI indicator is above 30 or when the price is higher than its previous high might be a cheat sheet that recommends selling when it crosses below 70.

Find Potential Buy or Sell Signals. The chart could have a bullish divergence signal. This could mean that the asset is worth investing in. It is also possible to consider selling the asset if you spot an indication of a bearish divergence.

Confirm the Signal It is also possible to consider other indicators such as moving averages, or levels of support and resistance to confirm the signal.

Manage Risk: As with any trading strategy, it's crucial to control risk when using RSI trading with divergence. This may include placing stop-loss or risk tolerance orders to limit losses and altering the size of the position.

In short the process of analyzing divergence trading with an RSI divergence cheat sheet involves finding potential buy or sell signals based on the divergence between price and RSI indicator, then confirm the signal by using other indicators, or analysis of price. This method can be risky so it's important that you examine it carefully using the historical data. See the recommended how you can help on best trading platform for more examples including trader reddit, coinbase stock crypto, trade desk forum, best crypto exchange for day trading, stock exchange automated trading system, trader joe's crypto, 3commas tradingview bot, multicharts automated trading, binance auto sell, etoro cryptocurrency list, and more.

[youtube]mII4WabEtGM[/youtube]